Property Tax

PROPOSED PROPERTY TAX INCREASE

The Property Tax Increase was passed on August 1, 2023.

See Resolution 08-01-2023 - Adoption of the Certified Tax Rate.

The Santaquin City portion of the property tax rate has not been raised since 2013. Through prudent fiscal planning and the efficient use of public funds, the City has maintained high quality services while keeping the tax burden low for residents and businesses. The City is considering a property tax increase to fund public safety and emergency services. The proposed increase would generate approximately $595,000 in annual revenue. The cost to the average household would be approximately $10 per month.

WHAT TO KNOW

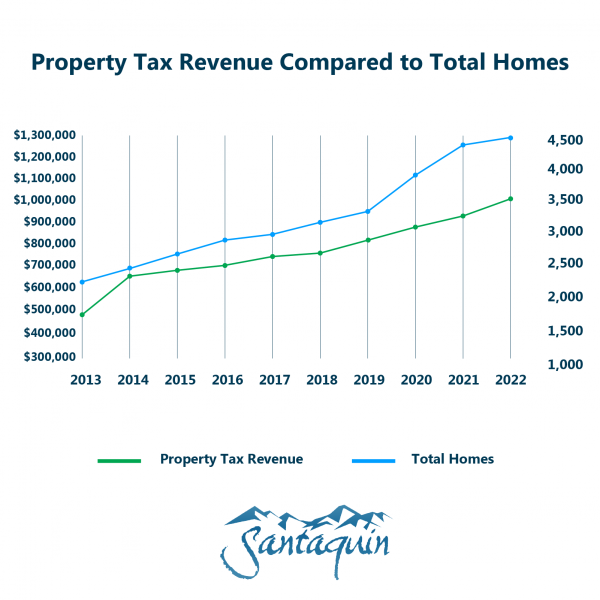

The number of homes in Santaquin City has grown by an unprecedented 107% in the past ten years, yet during that same time period the property tax rate has decreased by 57%. Per Utah State Law, the City must decrease the property tax rate when property values increase so that the overall amount of money the City receives stays the same. Unless the City adjusts the property tax rate, the overall revenues it receives will stay the same while costs continue to rise due to inflation and unprecedented population growth.

For the past eighteen months, City officials have thoroughly reviewed the city budget to reduce spending and increase revenues wherever possible. To cut spending, they have reduced staffing levels and halted repairs to buildings and delayed equipment purchases. To increase revenues, they have actively engaged federal and state partners, and pursued grant and funding opportunities. To offset budget shortfalls the City has withdrawn funds from its rainy day fund.

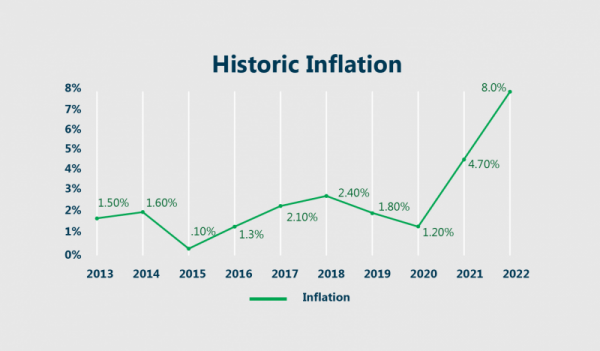

Despite these diligent efforts, the City is at a tipping point. Historically high inflation has quickly eroded the City’s budget due to rising costs for goods and services. Inflation and an unanticipated slowing of revenues from projected new growth has created a potential budget shortfall. To proactively address this issue, the Santaquin City Council is considering a proposed property tax increase of approximately $10 per month for the average household in Santaquin City.

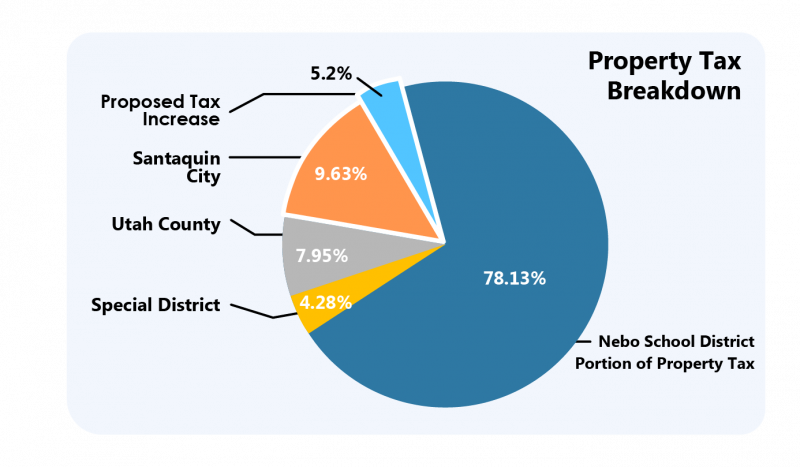

The proposed property tax increase would be approximately 5% of the total property taxes residents currently pay.

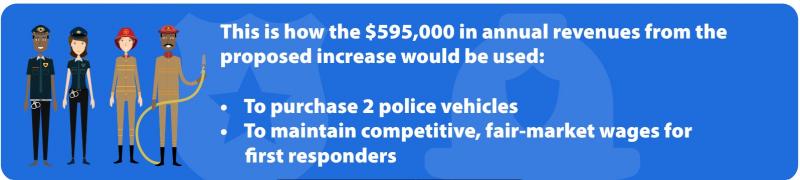

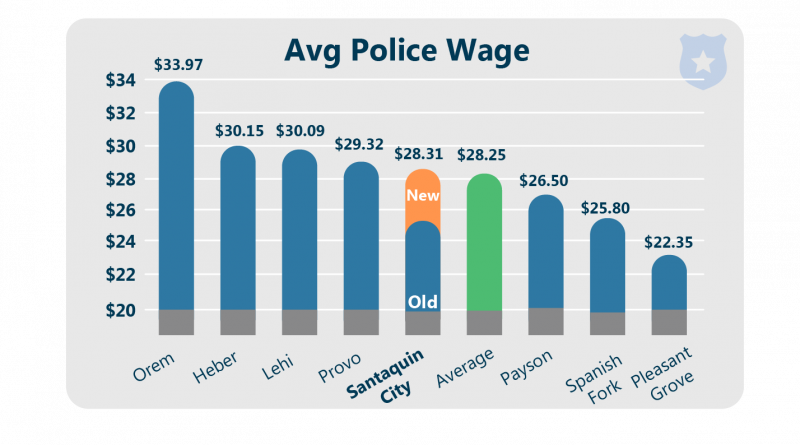

The City would dedicate the approximately $595,000 in annual revenues generated from this proposed increase to fund two new police vehicles and maintain the recent compensation increases for firefighters and police officers. These compensation increases have been vital to supporting competitive, fair market wages for first responders that serve the community and save lives. The modest increases keep the City competitive and allows retention of a qualified public safety workforce.

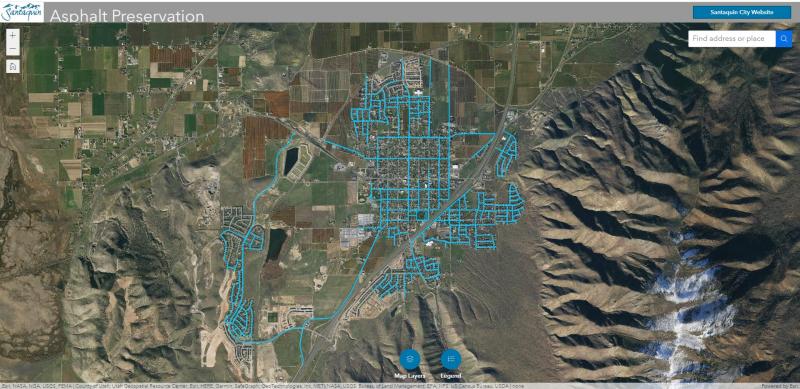

The City has a demonstrated history of full transparency and accountability with the use of property tax revenues. The City has kept its commitment to use the revenues from the last increase in 2013 to maintain critical infrastructure, improving 71.2% of all city-owned roads. Click on the map below to see the roads that have been maintained with revenues from the last property tax increase.

PUBLIC SAFETY & LIFE-SAVING EMERGENCY SERVICES

The number of Santaquin City police officers and firefighters has remained much lower than neighboring cities, while the demands for public safety and life-saving emergency services have increased significantly. The City is proposing to purchase two needed police vehicles and maintain recent wage increases for police officers and firefighters.

Santaquin provides residents with the highest level of prehospital care. For example, Santaquin Fire and EMS was the first agency from Provo to St. George to receive a Paramedic When Available EMS license. The license covers 366 square miles, providing services to Santaquin, Genola, Goshen, Elberta and areas of unincorporated Utah County. Having paramedics with increased knowledge, skills, and abilities improve patient outcomes and care. This includes advanced airway procedures, medications, and equipment. Santaquin Fire and EMS strive to provide the best employees with the highest level of training, skills and certifications to ensure the best treatment, response, and customer service. By maintaining this high-quality prehospital care, Santaquin Fire and EMS continue to save lives and improve the quality of life for residents.

HOW TO GET INVOLVED

PUBLIC OPEN HOUSE

To gather input from residents about the proposed tax increase, a public open house is scheduled for Thursday, July 27 from 5 p.m. to 8 p.m. in the City Council Chambers (2nd Floor) at the Santaquin City Public Safety Building located at at 275 West Main St. Santaquin, UT 84655. City elected officials and staff will be in attendance to inform interested residents and answer any questions.

PUBLIC HEARING

In addition to the public open house, the city council has set a public hearing date for Tuesday, August 1, 2023 at 7 p.m. The public hearing is scheduled before the city council considers adopting the property tax increase. It will be held in the City Council Chambers (2nd Floor) at the Santaquin City Public Safety Building located at 275 West Main St. Santaquin, UT 84655.

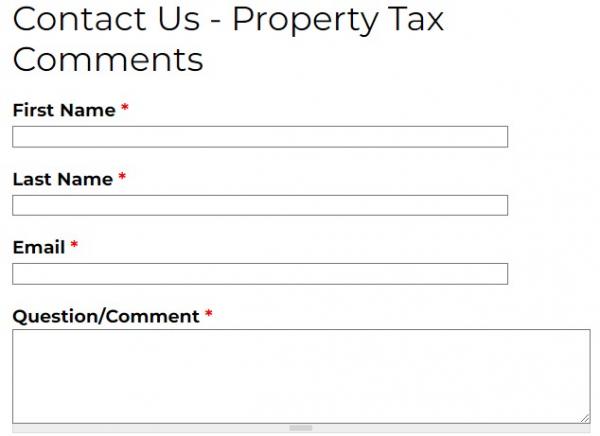

CONTACT US

We want to hear from you! Please submit your comments on the proposed property tax increase by clicking on and completing the form below.

CALCULATE THE PROPERTY TAX

Here is an easy-to-use calculator to help understand what the proposed tax rate might mean for you:

PROPERTY TAX CALCULATOR (downloadable)

1) Select your property type in the dropdown menu of options.

2) Type the assessed value for your property. If you cannot remember the assessed value of the property, the Utah County Assessor's office has an interactive parcel map you can use to look up assessed property value.

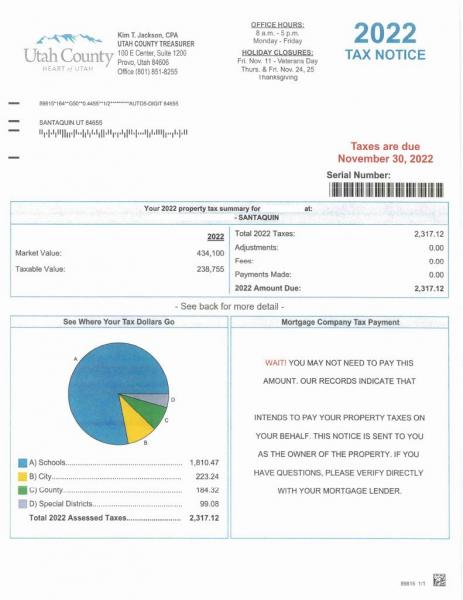

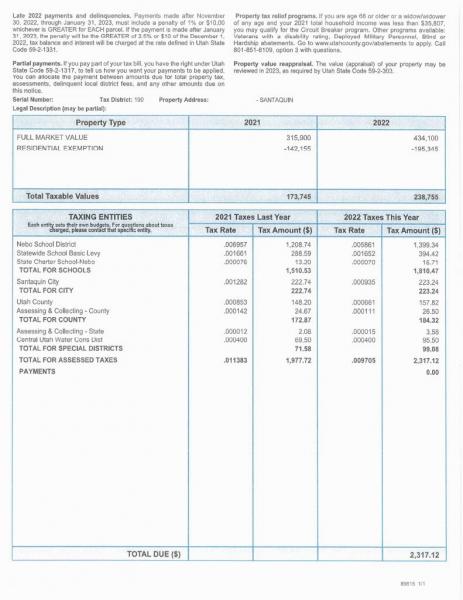

3) Every property owner will receive a notice in the mail from the Utah County Treasurer. Below is an example of what the notice looks like. Click to enlarge.

PROPERTY TAX RELIEF PROGRAMS

Utah County offers several property tax relief programs for qualifying residents. For more information, click HERE.